About us

We are an Africa-focused, client-led and digitally-enabled financial services organisation. We provide comprehensive and integrated solutions to our clients, driving inclusive growth and sustainable development across the continent.

We are committed to driving Africa's growth through our strategic priorities and unwavering focus on sustainability.

Our board of directors and leadership council bring a wealth of experience in banking, finance, and operating in African markets.

We believe in creating a workplace that reflects the diversity of the communities we serve, fostering a culture of inclusion and belonging.

We uphold the highest standards of corporate governance to ensure ethical and responsible business practices.

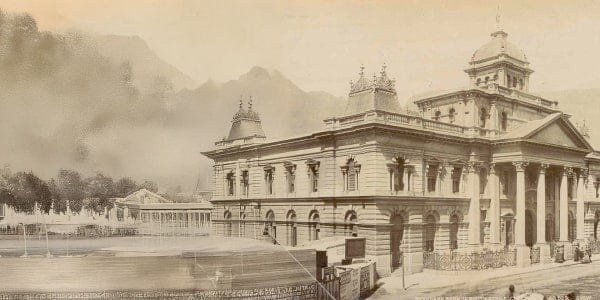

Discover our rich history and evolution as Africa's leading financial services group.

Explore our organisational structure and how we are positioned to deliver on our strategic priorities.

With a presence in over 20 sub-Saharan African countries, four global centres, and two offshore hubs, we are strategically positioned to serve our clients.

Our business units are dedicated to understanding and meeting the diverse needs of clients across Africa and abroad.