Standard Bank Group announces strong returns, increased dividends

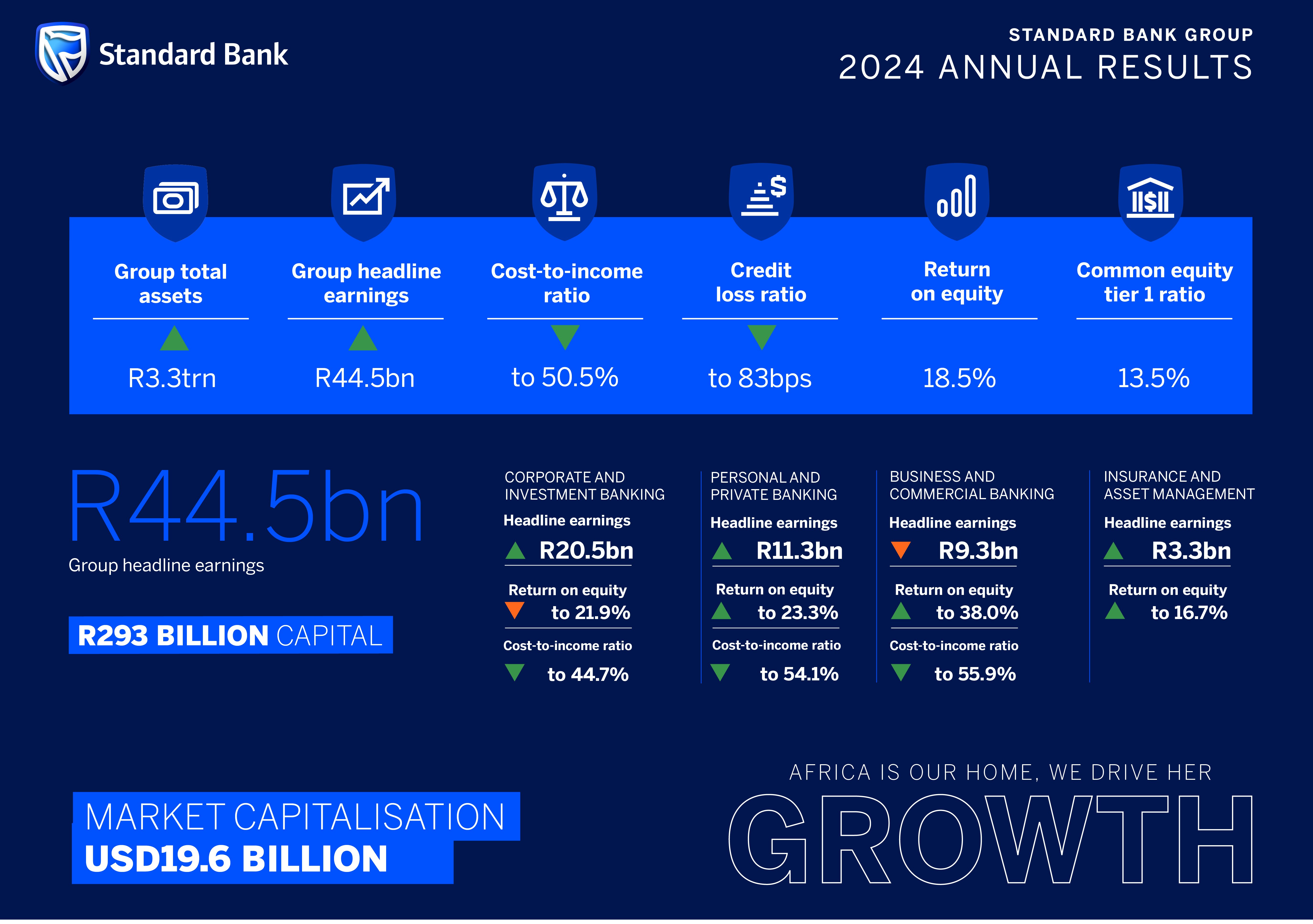

Standard Bank Group has reported R45 billion of headline earnings and a return on equity of 18.5%. This performance is underpinned by continued balance sheet growth, lower credit impairment charges and flat costs in the banking franchise and a robust performance in Insurance & Asset Management.

Sim Tshabalala, Standard Bank Group CEO says: “Our performance in 2024 reflects the strength of our diversified business and our commitment to delivering value to our stakeholders. We have seen double-digit earnings growth in South Africa, good contributions from our insurance and asset management business, and a strong operational performance from Africa Regions. The group remains on track to deliver on its 2025 strategy and targets.”

Operational Achievements

- Active clients: Increased by 4% to 20 million

- Flexi funeral policy base in South Africa: Grew by 19%

- Africa Regions: Contributed 41% to group headline earnings

- Sustainable finance mobilised: R74bn in 2024 and R177bn cumulatively since 2022

Customer migration and engagement on digital platforms

- Retail transactional clients in South Africa: 64% of clients are digitally active

- Digital revenue from retail clients in South Africa: Grew by 36%

- Mobile app logins by retail clients in South Africa: over 130m per month

- SME mobile banking volumes: Grew by 10%

- SME transactional clients in South Africa: 84% of clients are digitally active

The customer journey to digitisation has continued apace. Investments in digital platforms, especially mobile and online banking platforms have streamlined services and improved accessibility. 64% of transactional clients in PPB SA are digitally active, and in the business segment in South Africa 84% of clients are digitally enabled, while 90% of all transactions in this segment are digital.

“The Africa Regions’ portfolio delivered earnings of R18.0 billion and a ROE of over 28%. In 2024, Africa Regions once again contributed just over 40% to group headline earnings. Key contributors included Angola, Ghana, Kenya, Mauritius, Mozambique, Nigeria, Uganda, and Zambia. The group's diversified presence across the continent and hubs in key markets have positioned it well to capture growth opportunities and deliver value to stakeholders,” says Tshabalala.

East Africa benefitted from macroeconomic tailwinds such as lower inflation and strong foreign exchange inflows. Inflation is expected to remain low, interest rates to decline, and growth to remain robust in the region.

In West Africa, the group encountered high inflation, elevated interest rates, and weakening local currencies, particularly in Angola and Nigeria. Despite these headwinds, the region delivered a commendable performance, with strong growth in corporate and sovereign lending. The group's proactive engagement with clients and strategic investments in energy and infrastructure projects helped mitigate some of the adverse impacts. Inflation is expected to moderate, interest rates to remain high, and real GDP to improve.

In the South and Central Region, shifts in commodity prices and climate-induced energy crises, particularly in Malawi and Zambia, negatively impacted the region. Foreign exchange shortages and post-election protests impacted Mozambique. Despite the headwinds, the group’s South & Central Region performed well. Inflation, interest rates and growth are expected to be mixed in 2025, with improvements in Botswana, Malawi and Zambia but a deterioration in Mozambique.

The South African franchise delivered double-digit earnings growth in 2024, supported by increased client activity and improving credit trends. The formation of the Government of National Unity and stabilisation of electricity supply boosted consumer and business confidence. The group's focus on digital transformation led to a 6% increase in digitally active retail clients, enhanced customer experience and operational efficiency.

The Insurance and Asset Management business recorded a strong performance, with headline earnings growing by 17% to R3.3 billion. Assets under administration and management in the South African asset management business increased by 13% to R1.1 trillion, driven by positive net external third-party customer inflows and favourable investment market movements.

It has been three years since the Liberty minority buyout. The business has been integrated into the group and close collaboration across the banking, insurance and asset management businesses has been institutionalised. Integration costs were significantly less than expected and over R620 million of annualised pre-tax synergies have been realised, ahead of the original business plan. The corporate structure has been simplified, enabling considerable capital efficiencies and distributions. The cumulative distributions approved, since the Liberty transaction was announced, amount to R13 billion, more than the minority consideration on announcement.

Outlook

In January 2025, the International Monetary Fund forecast global real GDP growth of 3.3% for 2025 and 2026. This was premised on a continued decline in global inflation and a gradual normalisation of monetary policy as well as continued open trade. While recent developments, driven primarily by US policy changes and related tariffs, could lead to trade disruptions and inflation pressures, these are expected to be temporary and are not expected to disrupt the significant medium- and long-term opportunities we see across Africa.

Across Standard Bank’s portfolio of sub-Saharan African countries outside of South Africa, economic headwinds are expected to moderate and currencies to be more stable in 2025.

In South Africa, inflation is expected to remain well anchored in the target band of 3% to 6% and interest rates are expected to decline to 7.25% (one more 25 basis points interest rate cut in March 2025) and then remain flat for the rest of the year. This, together with ongoing policy reform and improved business and consumer confidence, will support economic growth. South African real GDP growth is expected to improve to 1.7% in 2025 and above 2.0% in 2026.

We are focused on delivering against our strategic priorities and remain on track to deliver on the 2025 targets we committed to in August 2021. For the twelve months to 31 December 2025 (FY25), the group’s three core metrics are as follows:

- Banking revenue growth of mid-to-high single digits in ZAR;

- Banking revenue growth slightly higher than operating expenses growth, resulting in a marginally declining cost-to-income ratio year on year; and

- Group ROE will remain well anchored in the group’s 2025 target range of 17% to 20%.

As we look beyond 2025, our footprint, people and capabilities provide us with access to many exciting opportunities linked to Africa’s development. We will both defend and grow our core businesses and pursue growth opportunities. We will focus on opportunities where we have a clear competitive advantage and that provide accretive risk-adjusted returns. More specifically, we want to lead Africa’s energy and infrastructure development, build Africa’s best private bank and maximise the value of our diversified portfolio by diligently re-allocating capital and resources to support our strategic growth ambitions. Accordingly, we commit to the following new medium-term targets (2026 – 2028):

- Headline earnings per share growth of 8% - 12%

- ROE target range of 18% - 22%

Tshabalala added, “We remain highly positive about Africa’s growth outlook, and we are confident in our ability to continue to manage risk efficiently, and to balance growth and returns. Our strong capital position and diversified earnings streams provide us with the flexibility both to fund growth opportunities and to pay dividends.”

Standard Bank’s purpose of ‘Africa is our Home, we drive her growth’, is well positioned to navigate uncertainty, mitigate risks and deliver resilient and growing earnings and attractive returns.