Standard Bank Group announces strong returns and increased dividends

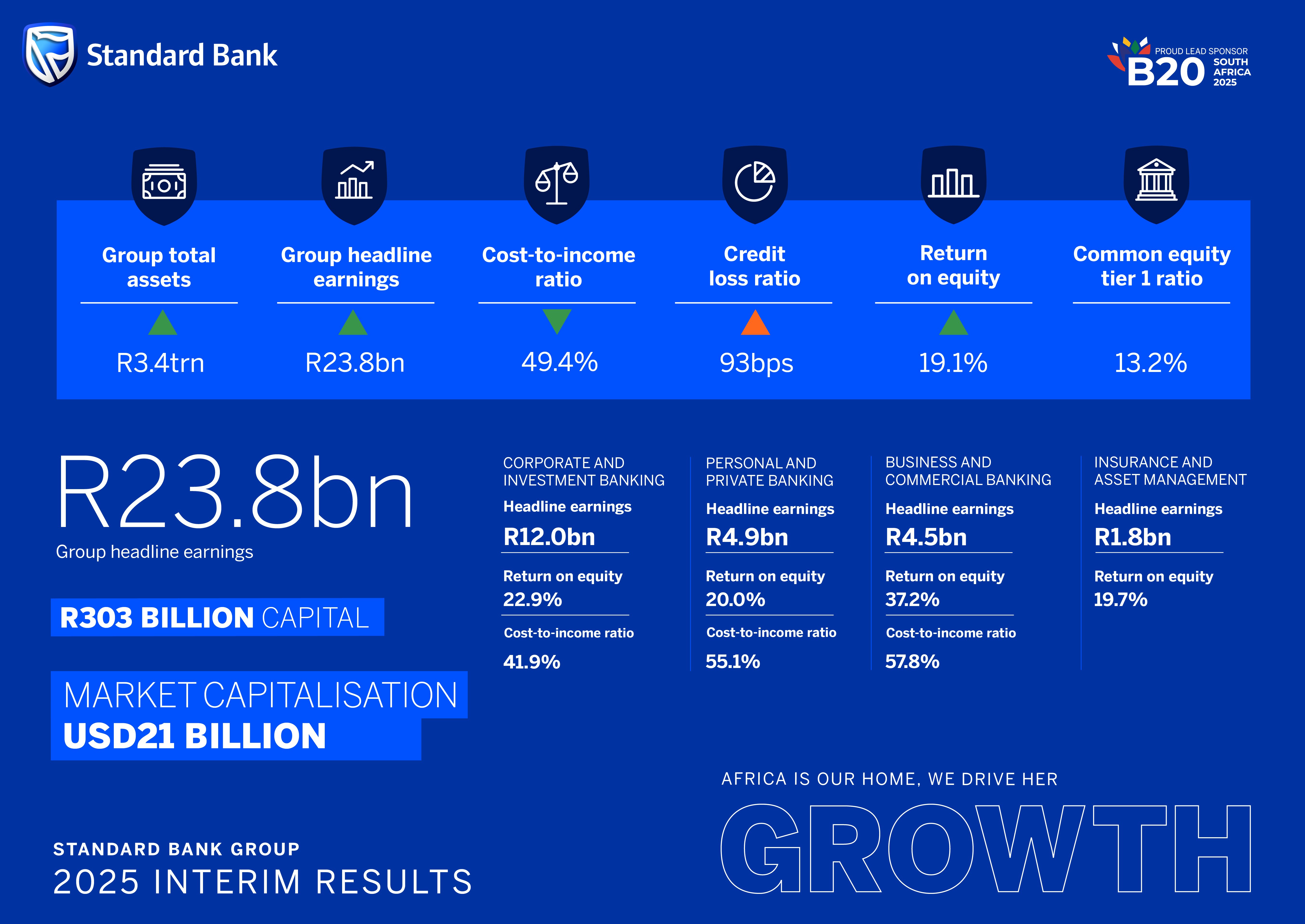

Standard Bank Group reported R24 billion in headline earnings and a return on equity of 19.1% for the half year ending 30 June 2025. This strong performance was underpinned by continued balance sheet growth, robust fee and trading revenue growth, and diligently controlled costs. Growth in credit charges was muted, as expected. Insurance and Asset Management recorded a continued upward trajectory in earnings and returns across.

Sim Tshabalala, Standard Bank Group CEO says: “Our performance in the first six months of 2025 reflects the robust franchise momentum in our businesses and active capital management despite the volatility linked to global developments. We remain confident and firmly on track to deliver on the 2025 targets outlined to the market in August 2021.”

Standard Bank maintained its focus on contributing to positive change in the countries in which it operates. Earlier in the year Standard Bank updated its sustainable finance mobilisation target, increasing from R250 billion by 2026 to R450 billion by 2028. Since 2022, the group has cumulatively mobilised over R230 billion in sustainable finance for clients, of which R53 billion was mobilised in the first half of 2025.

Operational Achievements

- Africa Regions: Contributed 41% to group headline earnings

- Sustainable finance mobilised: R53bn in the first half of 2025 and R230bn cumulatively since 2022

Customer migration and engagement on digital platforms in South Africa

- Digital retail clients: Grew by 7%

- Successful digital transactions: Increased by 12%

- Digital sales volumes: Grew by 33%

The deployment of personalised, data-driven offers to clients drove client retention and entrenchment and increased revenue. In South Africa, digital retail clients increased by 7%, successful digital transactions increased by 12% and digital sales volumes increased by 33%. Together this drove a 21% increase in digital revenue period on period.

In addition, growth in active business clients was underpinned by growth in the transactional and merchant account base in South Africa and targeted client acquisition strategies in Africa Regions. Investment banking origination reached a new record, driven in particular by opportunities in the Energy and Infrastructure sector.

Standard Bank’s South African franchises delivered earnings of R11.6 billion, our Africa Regions’ franchise R9.7 billion, our Offshore businesses R1.6 billion and the contribution from our 40% stake in ICBC Standard Bank PLC (ICBCS) was R0.8 billion (contributing 49% ,41%, 6% and 4% respectively to group headline earnings). The key contributors to Africa Regions’ headline earnings remained Angola, Ghana, Kenya, Mauritius, Mozambique, Nigeria, Uganda and Zambia.

Total net income growth exceeded cost growth, resulting in positive jaws of 0.6% and an improvement in the cost-to-income ratio to 49.4% (1H24: 49.7%).

Outlook

While trade disputes and high levels of policy uncertainty are expected to have a negative impact on global economic activity but are not expected to disrupt the significant medium-and long-term opportunities we see across Africa. As at July 2025, the International Monetary Fund (IMF) expected global real GDP growth of 3.0% and 3.1% for 2025 and 2026 respectively. This is down from its March expectation of 3.3% for both years. Global inflation is expected to continue to decline but at a slower pace than was expected in March 2025. In sub-Saharan Africa, the IMF expects inflation to decline and growth to be stable in 2025 and pick up in 2026 (IMF July 2025: sub-Saharan Africa real GDP growth of 4.0% and 4.3% in 2025 and 2026).

In South Africa, inflation is expected to remain in the bottom half of the current target range of 3% to 6% for the rest of the year and into 2026. Interest rates are expected to remain flat for the rest of the year. The SARB’s comments that it prefers inflation to be closer to 3%, clouds the outlook beyond 2025. The South African repo rate is expected to remain flat for the rest of the year followed by one further 25 basis point cut in early 2026. South African real GDP growth is expected to be 0.9% in 2025 and improve to 1.3% in 2026. This is lower than the 1.7% and 2.0% for 2025 and 2026 respectively, which we expected in March 2025. (Macro expectations as per Standard Bank Research). However, this outlook remains sensitive to developments on tariffs, including both the rate thereof and the exemptions applied.

We reaffirm the group’s three core metrics for the twelve months to 31 December 2025 (FY25). These are summarised as follows:

- Banking revenue growth of mid-to-high single digits in ZAR;

- Banking cost-to-income ratio to be flat to marginally down year on year; and

- Group ROE will remain well anchored in the group’s 2025 target range of 17% to 20%

Standard Bank is committed to delivering the group’s 2026 - 2028 targets as outlined in March 2025:

- Headline earnings per share growth of 8% - 12%

- ROE target range of 18% - 22%

Tshabalala added, “We remain confident and firmly on track to deliver on the 2025 targets as outlined to the market in August 2021.”